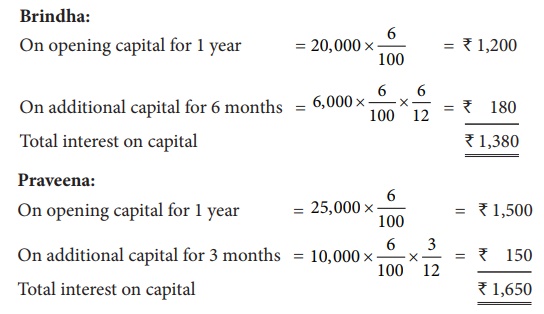

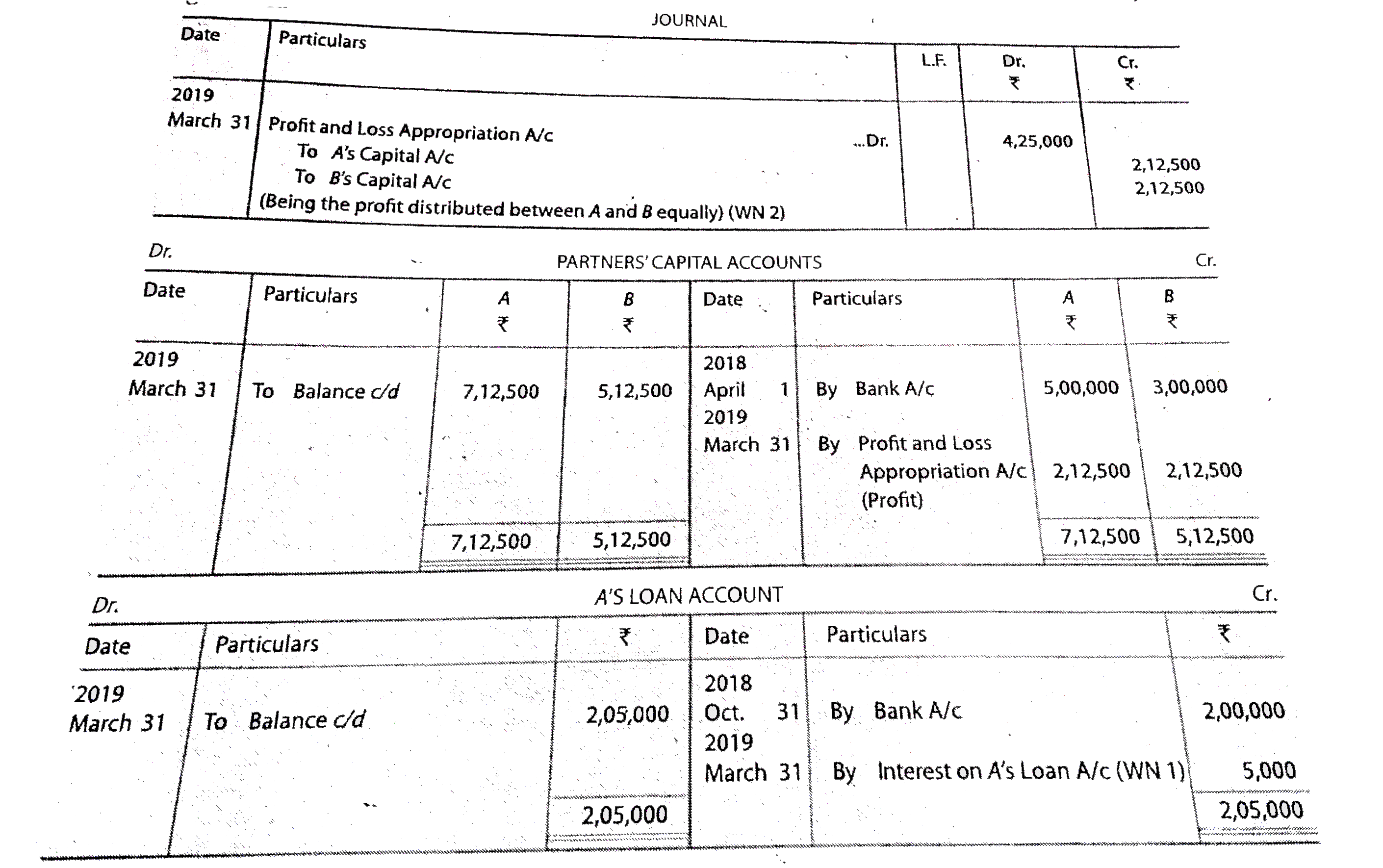

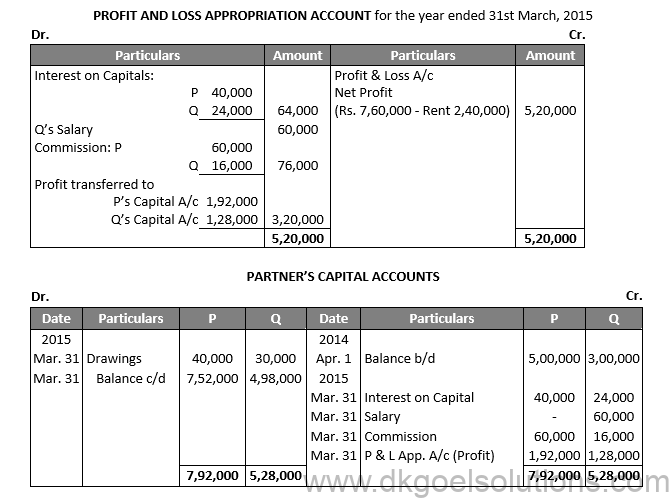

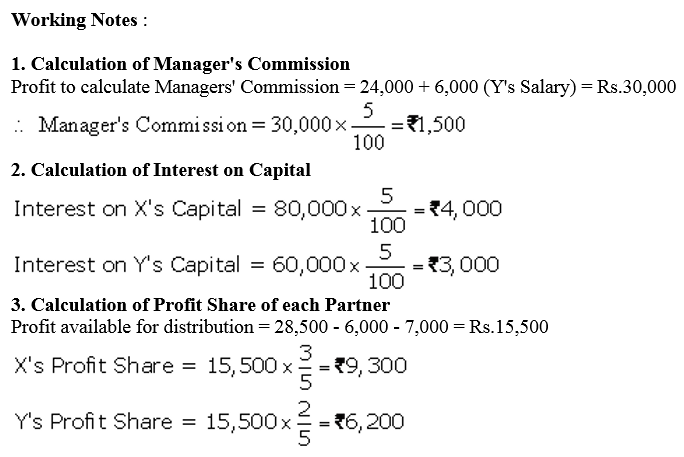

In the absence of partnership deed, profits and losses will be distributed equally among the partners Answers 10 – a) Equal Fundamentals of Partnership class 12 MCQ – Explanation 11In the absence of partnership deed, no interest in allowed on capital and no interest isWN 2 Calculation of Profit Share of each Partner In the absence of partnership deed, profits of a firm are distributed equally among all the partners Pofit of A Page No 280 Question 7 A and B are partners in a firm sharing profits in the ratio of 3 2 They had advanced to the firm a sum of ` 30,000 as a loan in their profitsharing ratio on 1st October, 17 The Partnership Deed is silent Their fixed capitals were A ₹ 9,00,000 and B ₹ 4,00,000 The partnership deed provided the following (i) Interest on capital @ 10% pa (ii) A's salary ₹ 50,000 per year and B's salary ₹ 3,000 per month Profit for the year ended 31st March 19 ₹ 2,78,000 was distributed without providing for interest on capital and partner's

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

What are the rules in the absence of partnership deed

What are the rules in the absence of partnership deed-Death of a partner dissolves the partnership and the rights of the representatives of the deceased partner would depend on the provisions of the partnership deedIn the absence of any agreement or decision by arbitration, accounts will have to be prepared as on the date of death and the profit or loss ascertained In the absence of Partnership deed, specify the rules relating to the following asked in Accounts by SonaSingh ( 644k

1

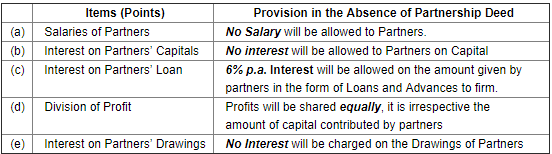

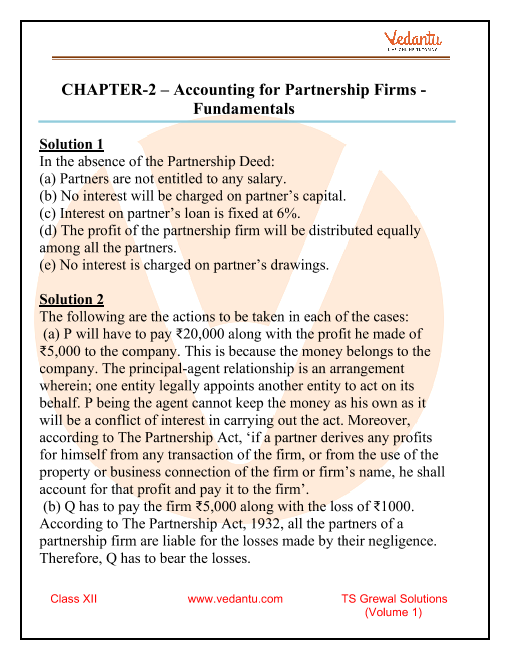

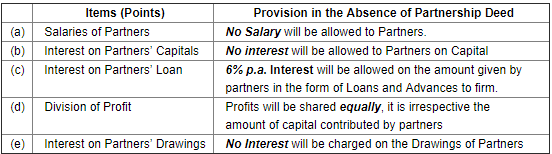

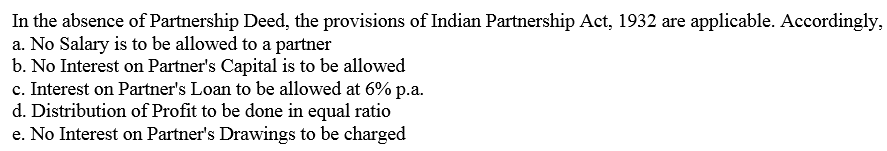

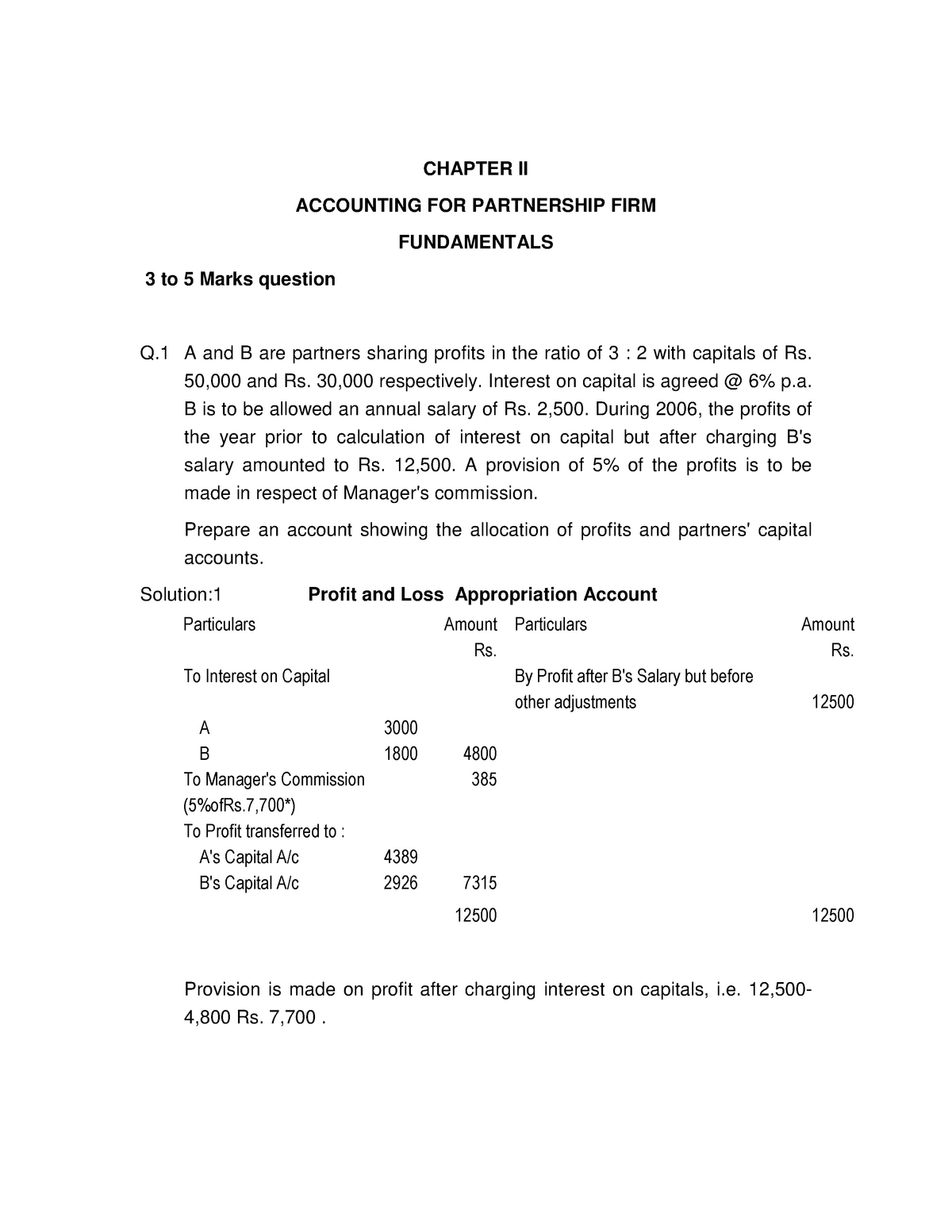

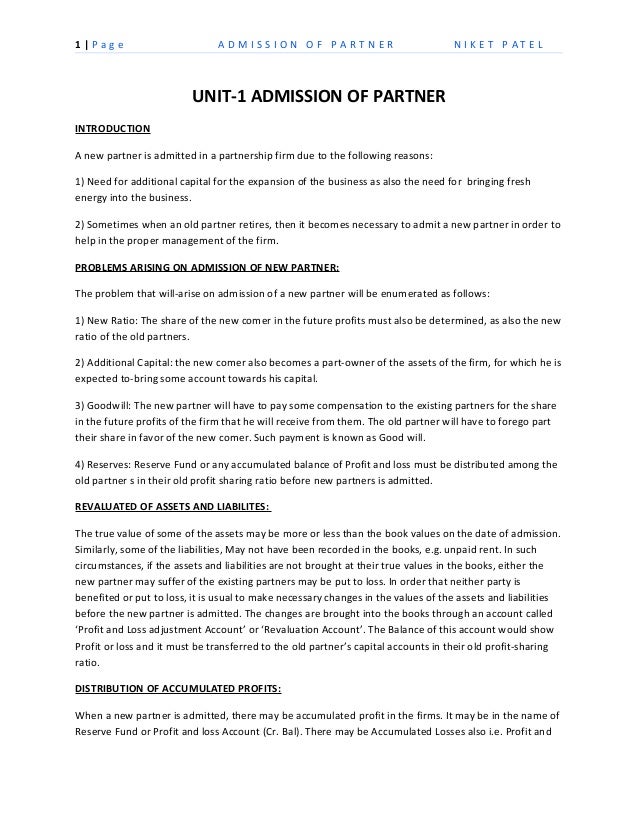

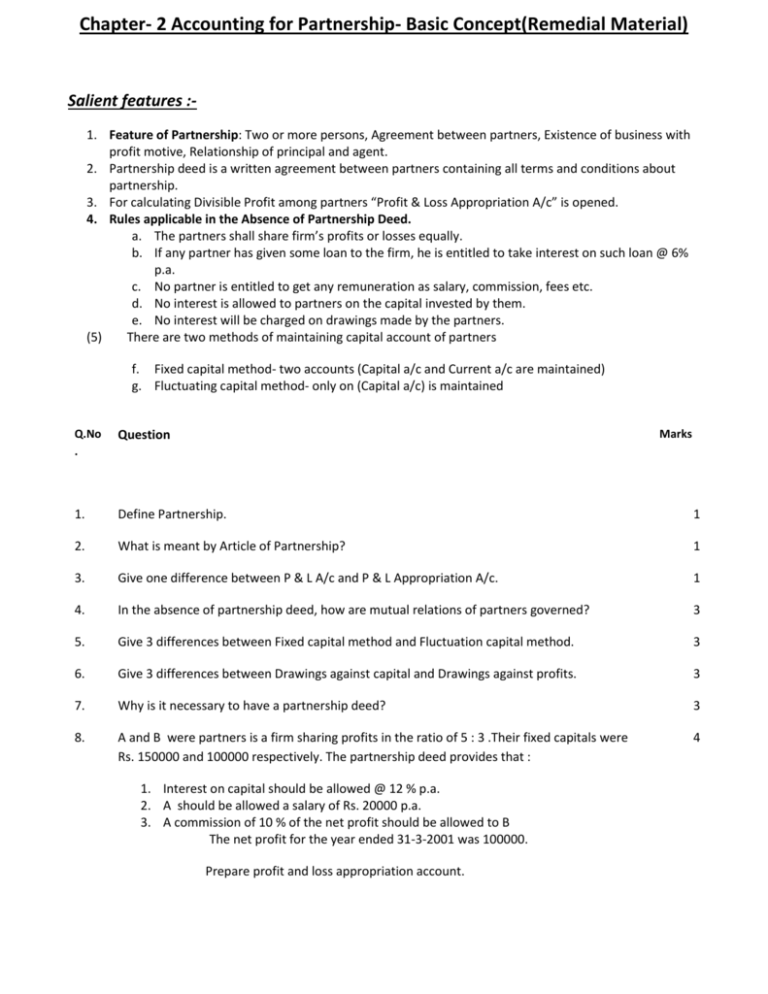

Normally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If as per the partnership deedDivision by Responsibility One way to share profit and losses in the absence of a limited partnership agreement is to divide them by the responsibility carried out by each member The amount of responsibility a partner has is usually known by the partners when the partnership is formedAs per Indian Partnership Act, 1932, 6% pa Interest will be allowed on the loan amount of partners (d) Division of Profit In the absence of partnership deed profit is distributed equally (e) Interest on Partners' Drawings No Interest is charged from partner in such case (f) Interest on loan to partner No Interest is charged

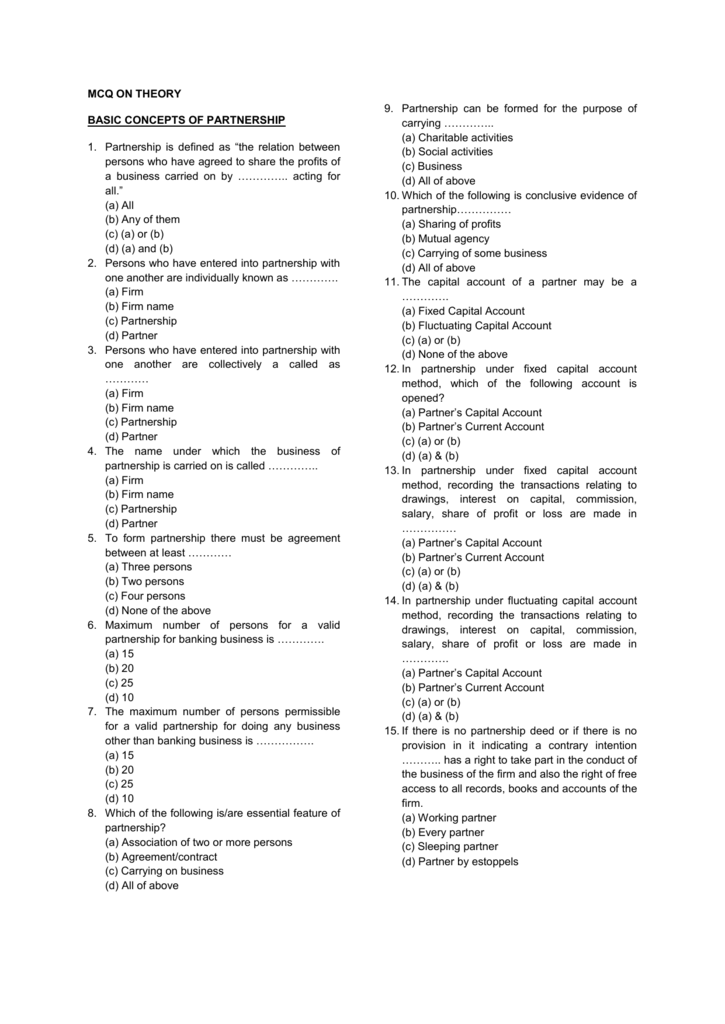

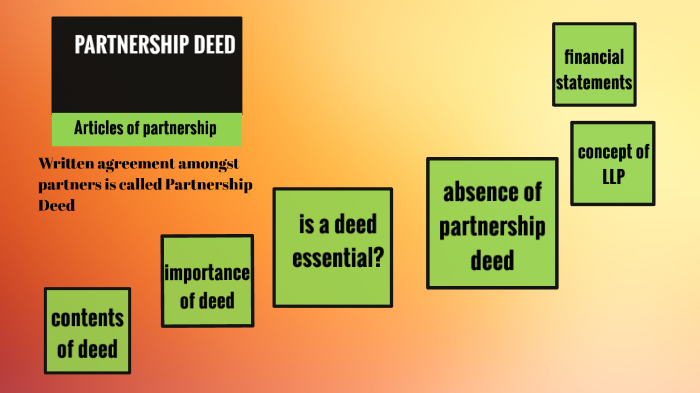

The document which contains the terms and conditions of partnership is called Partnership is called Partnership Deed 10 In the absence of a specific agreement, interest on capital is paid only out of profit In the absence of partnership deed, profit sharing ratio is (a) in capital ratio (b) equally (c) sacrificing ratio (d) as decided by the partners Answer (b) Question 3 Calculate the interest on Ram's drawings @ 10% if he withdrawn Rs 24,000 during the yearA partnership is a trusting and believing relationship There are certain differences between the accounts prepared by a partnership firm and those prepared by a sole proprietorship firm The essential features of partnership accounting also include maintenance of capital accounts for partners, the distribution of profits to partners, and so on

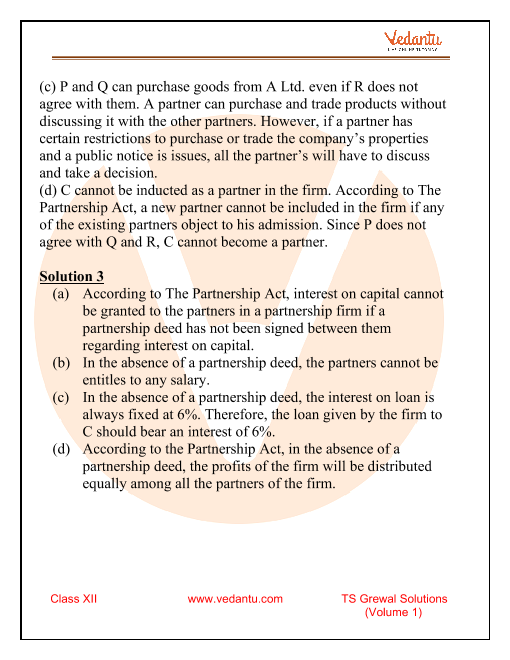

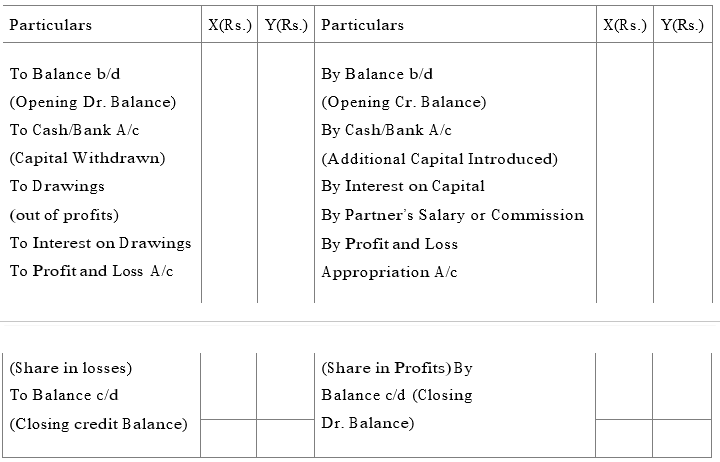

In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partnerA Profit and Loss Appropriation Account is prepared to show the distribution of profits among partners as per the provision of Partnership Deed (or as per the provision of Indian Partnership Act, 1932 in the absence of Partnership Deed) In the absence of partnership deed partners are entitled to receive _____ (a) Interest on Capital (b) Interest on Loan In the absence of partnership deed, profit will be distributed equally between all partners Answer Answer True Profit for the year ended 31st March 19 ₹ 2,78,000 was distributed without providing for interest on

Class 12 Accounts Fundamental Of Accounts Notes

Question 04 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

In the absence of partnership deed, the provisions of Indian Partnership Act of 1932 applies According to the act, if there is no agreement regarding the ratio in which profits are to be shared, then profits (or losses) are to be shared equally among all the partners Distribution of Profits The profits are distributed as per the partnership deed However, in the absence of a partnership deed, the profits are distributed equally among the partners It depends upon the Articles of Association or the decisions of directors Regulatory Authority It is regulated by the registrar of firms under the State The partnership deed provided that interest on capital shall be allowed at 9% per annum During the year the firm earned a profit of Rs 7,800 Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended

Free Partnership Agreement Template Create A Partnership Agreement

Ram Rahim And Roja Are Partners Sharing Profit And Loss In The Ratio Of 3 2 1 As Per Partnership Deed Sarthaks Econnect Largest Online Education Community

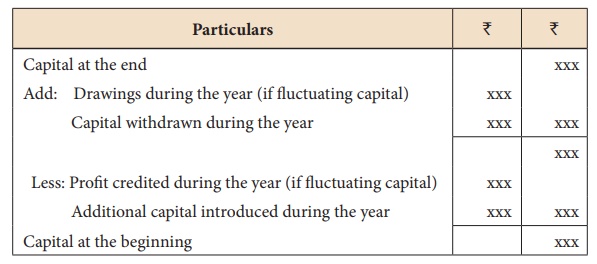

If there is no partnership deed, the profit should be distributed, As per capital ratio Anyway, if all partners hasn't shared the effort equally, then the effort put on business also should consider with investment Without partnership deed, profit will The ratio in which the profits or losses are to be shared among the partners If the profit sharing ratio is not written in the deed, the profit will be distributed equally as per the provisions of the partnership Act Rules to be followed in the Absence of a Partnership Deed 1 The partners are entitled to share the profits or losses equallyNet Profit as per the Profit & Loss A/c is transferred to the Profit and Loss Appropriation A/c This net profit is then appropriated as per the terms of the Partnership Deed Divisible Profit means profit after crediting Interest on Drawings (if any) to Profit and Loss Appropriation Account and debiting salary to partners, interest on capital, etc

Partnership Accounts Profit And Loss Distribution In Absence Of Partnership Deed Youtube

Provisions Of Partnership Deed Indian Partnership Act 1932

In the absence or of any Partnership Agreement, the profits or losses of the firm are divided (A) In Capital Ratio (B) In Equal Ratio In any of these two ratios (D) None of these Answer In Equal Ratio 4 In the absence of partnership deed, the partner will be In the absence of an agreement, the partnership Act is applied, However, the act leaves it to the discretion of partners The written agreement between partners will be helpful in case of disputes between the partners Important Points of a Partnership Deed The following points are to be mentioned in the partnership deed Name of the partnersA) Interest on capital b) Interest on drawings c) Interest on loan d) Distribution of profit or losses e) Salary to partner Answer a) Interest on capital – Nil b) Interest on drawings Nil c) Interest on loan – 6% Pa d) Distribution of profit or losses – Equally

Set 1 Cbse All India Previous Year 08 Expense Equity Finance

2

11 In the absence of partnership deed mutual relations are governed by the Indian partnership act T 12 Capital in the beginning is calculated by subtracting drawing and adding profit distributed F 13 Drawing against capital means drawing by a partner out of his/her expected share in the profit of the current year F 14(ii) In the absence of partnership deed, Profit should be distributed in equal ratio not in proportion of capital Dhiman Claims (i) His Claim is correct and profit should be distributed in equal ratio How do you treat the following in the absence of partnership deed?

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Absence Of Partnership Deed Profit Loss Appropriation Goodwill Ca Cpt Cs Cma Foundation Youtube

The following are the provisions that are relevant to the partnership accounts in absence of partnership deed (i) Profit Sharing Ratio When a partnership deed is not made or even if it is made and silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act 1932, profits and losses are to be sharedIn the absence of a partnership deed and where there is no indication as to the agreement between the partners in this aspect, it should be considered as equal share for all partners The ratio may be specified in terms of absolute values or it may be expressed as the ratio of their Capital account balances or it may be based on anything else as agreed upon by the partnersWhen the partnership earns profit or loss, it is distributed among the partners according to their ratio If there is no agreement about the ratio of partners, profit or loss will be distributed equally

Doc Name Of The Partnership Zeroes Academia Edu

Ramesh Wants To Retire From The Firm The Gain Profit On Revaluation On That Date Was Rs 12 000 Sarthaks Econnect Largest Online Education Community

State any six contents of a partnership deed Answer The contents of the partnership deed are The name of the firm and nature and place of business Date of commencement and duration of business Names and addresses of all partners Capital contributed by each partner Profitsharing ratio Amount of drawings allowed to each partner Question 31 in the absence of a partnership agreement, the law says that income and loss should be allocated a based on their length of time with the partnership b equally c according to their capital investments d based on salary allowances 2 the number of shares that a corporations charter allows it to sell is referred to as Question A and B are partner's sharing profit in the ratio 21 on 31st March 19, firm's net profit is Rs 86,000 the partnership deed provided interest on capital A and B Rs 5,000 to Rs 7,000 respectively and Interest on drawing from charged A Rs 1,000 per month Calculate profit to be transferred to Partner's Capital A/c

Question 02 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Share Shradha Kumari Provision of partnership act 1932 Rules applicable in the absence of partnership deed which will be relevant for accounting such as , no interest is allowed to partners on capital, no interest will be charged on drawings made by partners so same rule is applicable in the absence of partnership deed that is the profit and losses will be Profit will be distributed in Equal ratio When there is no partnership deed or partnership deed is prepared but it is silent on profit sharing ratio, in such a case rules of Partnership Act, 1932 will be applicable According to which, profits or losses will be shared by the partners equally irrespective of their capitals 34 In the absence of partnership deed, partners share profits or losses (A) In the ratio of their Capitals (B) In the ratio decided by the court Equally (D) In the ratio of time devoted Answer Answer C

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

Provision in partnership deed and Indian Partnership Act 1932 relating to distribution of profit, interest ob capital and drawings, interest on partners loan, salary or commission to partner Learning objectives Understand the meaning of final accounts Know the importance of final accounts Understand meaning and features of partnership 1 Profit sharing Ratio Profits and losses would be shared equally among partners 2 Interest on capital No interest on capital would be allowed to partners If tehre is an agreement to allow interest on capital it is to be allowed only in case of profits 3 Interest on drawings No interest on drawings would be charged from partners 4

Class 12 Accounts Fundamental Of Accounts Notes

2jnomj8w4bzlom

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

What Is Partnership Definition Types Partnership Deed And Characteristics The Investors Book

Question 02 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Ts Grewal Solution Class 12 Chapter 5 By Studies Today Issuu

Importance

Day 5 Class 12th Commerce Rules Applicable In The Absence Of Partnership Deed Youtube

Partnership Deed Commerceiets

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

Cbse Class 12 Accountancy Accounting For Partnership Firms Fundamentals Notes Concepts For Accountancy Revision Notes

Partnership Accounts

Rbse Solutions For Class 12 Accountancy Chapter 1 General Introduction Of Partnership

A And B Entered Into Partnership On 1st April 18 Without Any Partnership Deed They Introduced Capitals Of Rs 5 00 000 And Rs 3 00 000 Respectively On 31st October 18 A

2

2

The Csg Team Csec Pob Study Notes Forms Of Business Facebook

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

Partnership Property In The Partnership Act Ipleaders

1

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

Partnership Fundamentals Objective Type Mission Accountancy

How Does The Profit Sharing Work Among Partners In A Pvt Ltd Company Quora

Provisions Of Partnership Deed Indian Partnership Act 1932

Acc Ppt Akhil Bhartiya Vidya Sansthan Samarth Shiksha Samiti

Class 12 Accounts Fundamental Of Accounts Notes

Accounting For Partnership Notes Class 12 Accountancy

2

No Provision In Partnership Act To Show Profit Loss Ratio In Partnership Deed

Cbse Class 12 Lesson 2 Applicability Of Provisions In The Absence Of Partnership Deed In Hindi Offered By Unacademy

Dissolution Of Partnership Firm Settlement Of Accounts

Profit And Loss Appropriation Account Accountancy Knowledge

Important Questions For Cbse Class 12 Accountancy Past Adjustments And Guarantee Of Profits To A Partner

Profit And Loss Appropriation Account Accountancy Knowledge

1

Hots Accountancy Class 12 Chapter 2 Accounting For Partnership Basic Concepts

Partnership Deed Format Format Of Partnership Deed Finacbooks

Dk Goel Solutions Class 12 Accountancy Chapter 2 Accounting For Partnership Firms Fundamentals

Ncert Solutions For Class 12 Accountancy Not For Profit Organisation And Partnership Accounts Chapter 2 Accounting For Partnership Basic Concepts Latest Edition Shaalaa Com

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Provisions Of Partnership Deed Indian Partnership Act 1932

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

In The Absence Of Partnership Deed Youtube

Class 12 Accounts Fundamental Of Accounts Notes

Ch 4 Partnership Accounts Notes 181 Retirement And Death Of A Partner Accountancy 1 Retirement Acirc Euro Ldquo Meaning Calculation Of New Profit Sharing Ratio And Pdf Document

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Difference Between Partnership Firm And Company With Comparison Chart Key Differences

Partnership Accounts Example Profit Distribution In Absence Of Partnership Deed In Hindi Youtube

Distribution Of Profit Among Partners Profit Loss Appropriation Account

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

Partnership Accounting Sample Questions Iba Studocu

Accounting For Partnership Notes Class 12 Accountancy

12th Accountancycbse Omqs Flip Ebook Pages 1 50 Anyflip Anyflip

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Ram Rahim And Roja Are Partners Sharing Profit And Loss In The Ratio Of 3 2 1 As Per Partnership Deed Sarthaks Econnect Largest Online Education Community

Chapter 2 Distrubution Of Profits Pdf Partnership Interest

12th Accountancycbse Omqs Flip Ebook Pages 1 50 Anyflip Anyflip

Class 12 Accounts Fundamental Of Accounts Notes

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Q1 In Absence Of Partnership Deed How Is The Profit Divided In Partners Cbse Class 12 Accounts Youtube

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Profit And Loss Appropriation Account Accountancy Knowledge

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Partnership Deed

Accounting For Partnership

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Books

1

Profit And Loss Appropriation Account Template Pdf Chapter 1 Accounting For Partnership Basic Studocu

Accounting For Partnership Notes Class 12 Accountancy

2

Profit And Loss Appropriation Account Accountancy Knowledge

Reema And Seema Are Partners Sharing Profits Equally The Partnership Deed Provides That Both Sarthaks Econnect Largest Online Education Community

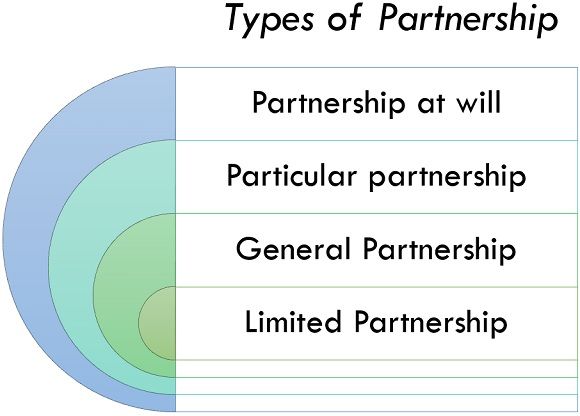

Partnership Firm Types Deed Agreements In India Indiafilings

Partnership Deed By Dhanya V L

Pdfcoffee Com

All You Need To Know About The Indian Partnership Act 1932

Cbse Papers Questions Answers Mcq Cbse Class 12 Accountancy Chapter 2 Accounting For Partnership Firms Fundamentals Questions And Answers Eduvictors Cbsenotes Class12accountancy

What Is Partnership Definition Types Partnership Deed And Characteristics The Investors Book

0 件のコメント:

コメントを投稿